E‑commerce in France

France is a mature and highly marketplace‑driven e‑commerce market, where platforms like Amazon, Cdiscount and Fnac‑Darty play a central role in the purchasing journey. High digital penetration and clear expectations around fast delivery, secure payment methods and smooth returns strongly shape consumer behaviour. Particularly in urban regions, online purchasing intent is exceptionally high, creating a stable and well‑structured market with clear competitive dynamics for international retailers.

The French market at a glance

Purchasing power

With an average purchasing power of €24,328 per capita, France ranks among Europe’s strongest consumer markets, placing 14th in the European comparison. Purchasing power varies significantly across regions, with economically strong metropolitan areas performing well above the national average. Leading the field is the Île‑de‑France region around Paris, reaching €41,737 per capita and ranking among Europe’s most affluent metropolitan areas.

For international retailers, this concentration of high‑income regions offers substantial sales potential — particularly in urban‑driven categories such as fashion, home & living, beauty and premium products. Overall, France remains an attractive and reliable e‑commerce market due to stable economic indicators, strong consumer demand and a digitally engaged population.

Internet usage and consumer behaviour in France

France is a digitally mature and growing e‑commerce market, offering attractive opportunities for retailers due to its size and its high transaction volume. Around 95% of the population is online, representing more than 64 million potential customers.

E‑commerce continues to expand: in 2024, online revenue surpassed €175 billion, marking +9.6% growth compared to the previous year.

Preferred payment methods

The French market is dominated by credit and debit cards as well as e‑wallets, while invoice‑based payments – unlike in Germany or Austria – play only a minor role.

Payment Method Breakdown

- Cards (credit & debit, incl. Cartes Bancaires (CB)) – 55%

- E‑wallets (e.g., PayPal, Apple Pay, PayLib) – 27%

- Bank transfer (SEPA, instant payment) – 11%

- Buy Now, Pay Later (BNPL, e.g., Alma) – 7%

.webp)

Most popular marketplaces and shops

France is a highly marketplace‑driven e‑commerce market. A significant share of online revenue comes from platforms that many consumers use as their primary starting point for online shopping. Key marketplaces include:

- Amazon – the undisputed market leader, dominant across nearly all product categories

- Cdiscount – the largest French generalist marketplace, particularly strong in electronics, household goods and furniture

- Fnac‑Darty – leading in consumer electronics and household appliances

- Veepee (formerly Vente‑Privee) – established in fashion, accessories and home textiles, especially for flash sales

- ManoMano – leading platform for DIY, home improvement, gardening and home projects

- Shein & Temu – very fast‑growing, especially in the fashion segment and among younger audiences

- Zalando – European specialist for fashion and footwear with strong market presence in France

Last‑Mile Carriers

France has a dense and well‑developed logistics network.

- Colissimo (La Poste) is the most important and far‑reaching B2C parcel carrier in the country. With its nationwide infrastructure, high delivery reliability and strong brand recognition, Colissimo is the preferred choice for many French consumers.

In addition to Colissimo, other relevant carriers on the market are:

- Chronopost – the express specialist within the La Poste Group, ideal for fast deliveries.

- DPD France (Pickup‑Netzwerk) – strong in parcel shops and pick‑up points, widely used in urban and suburban areas.

- Mondial Relay – popular for cost‑efficient deliveries through a dense network of pick‑up points.

Delivery and fulfilment preferences

In France, home delivery remains the preferred delivery method, accounting for around 70% of shipments. At the same time, collection points and pick-up points are gaining momentum: their current share lies at 6–8%, with a clear upward trend.

In cities and metropolitan areas, 48–72 hours is considered the standard delivery timeframe and strongly shapes expectations around reliable fulfilment — supported by a very high first-attempt delivery success rate of around 91%.

When making purchasing decisions, French online shoppers place great importance on transparency and clear shipping costs: high or unclear shipping fees are among the most common reasons for cart abandonment.

All services from a single source

From customer-friendly delivery options to seamless returns management to real-time tracking and data-based analyses — exporto combines all services for your international growth in one end-to-end solution.

Fast delivery

Offer your customers in Europe an outstanding customer experience—with the shortest processing times, individual shipping options for each destination country and deliveries by the most popular last-mile carriers.

Seamless integration

Thanks to simple API integration, our services fit seamlessly into your existing set-up—flexibly, individually and with minimal technical effort.

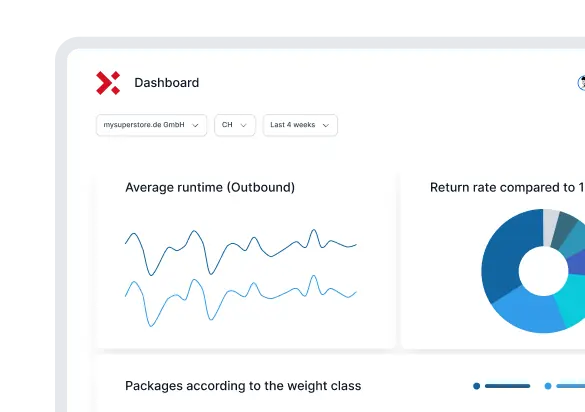

Full transparency

With the help of an intuitive dashboard, you can keep an eye on the status of your international shipments in real time—with automated data synchronization for maximum transparency.

Partner who complement our solution in the French market

We are looking forward to hearing from you!

With our end‑to‑end solution, you get all services from a single source: Logistics, tax, customs and software. Everything is perfectly coordinated and as simple as “plug & play”.

Marvin Schwarz

Sr. Business Development Representative